Market Performance Study on 658861111, 2703923005, 915078968, 83645237, 8123124262, 4618082097

The market performance study of asset identifiers 658861111, 2703923005, 915078968, 83645237, 8123124262, and 4618082097 presents a thorough examination of their effectiveness and profitability. Key performance metrics reveal significant trends in market fluctuations, indicating both risks and opportunities. This analysis raises pertinent questions about future strategies and potential growth avenues. Understanding these dynamics could be crucial for investors seeking to navigate a complex financial landscape. What insights might emerge from a closer look?

Overview of Asset Identifiers

Asset identifiers serve as critical tools in the financial markets, facilitating the categorization and tracking of various financial instruments.

Their significance lies in enhancing transparency across diverse asset classes, enabling investors to distinguish between securities efficiently.

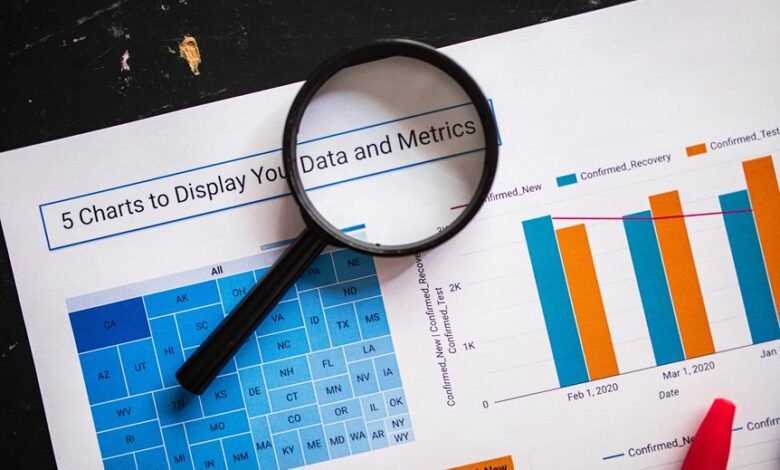

Performance Metrics Analysis

A comprehensive analysis of performance metrics is essential for evaluating the effectiveness and profitability of various financial instruments.

Key performance indicators provide insights into operational efficiency while facilitating informed risk assessment.

Market Trends and Fluctuations

While fluctuations in market trends can often appear erratic, they are influenced by a complex interplay of economic indicators, investor sentiment, and geopolitical events.

Understanding market dynamics is crucial for developing effective investment strategies.

Volatility analysis provides insights into potential risks and opportunities, enabling investors to navigate changing landscapes and optimize their portfolios in response to shifting market conditions.

Future Growth Opportunities

Identifying future growth opportunities requires a comprehensive analysis of emerging sectors, technological advancements, and demographic shifts.

Investors must adopt innovative investment strategies that align with these trends, particularly in renewable energy, biotechnology, and artificial intelligence.

Conclusion

In conclusion, the market performance study of the identified assets underscores the critical importance of understanding performance metrics and market trends. As investors navigate the complexities of fluctuating markets, one must ask: how can these insights be leveraged to enhance investment strategies? By recognizing both the risks and opportunities, stakeholders can make informed decisions that align with evolving market dynamics, ultimately positioning themselves for future growth and success in their investment endeavors.